UK Defence Industrial Strategy - Jam by 2035

The Government has released the UK's Defence Industrial Strategy: Making Defence and Engine for Growth. My first thought as I worked my way through was that it's a tediously repetitive document at least twice as long as it needs to be. That said, there is little to object to in the content, although as the document itself notes - the devil is in the implementation. What I found more significant was what was missing from the document. And while the 'Accountability Table' is a welcome addition, it inherits the Strategic Defence Review's lack of urgency with its 'jam by 2035' promises when I fear our global opponents are unlikely to wait that long....

The return of industrial offsets

Bringing offsets back is a significant change policy change for UK defence procurement (subject to public consultation...) with the UK previously favouring a system of 'Gentlemen's Agreements' with major foreign Primes and bid assessment criteria that reward UK content in the proposal.

This made sense while we were enjoying the 'peace dividend' following the end of the Cold War, but industrial offsets could potentially offer a more flexible way of ensuring UK industry benefits from the defence budget without the time, cost and risk associated with shoehorning UK companies into existing supply chains for 'off-the-shelf' procurements.

There are numerous examples, including Boxer and Wedgetail, where the programme has suffered significant delays due in part to the complications of disrupting established supply chains to incorporate UK subcontractors.

With an urgent need to re-arm and improve delivery, using combinations of direct and indirect offsets might allow UK industry to gain extra work while allowing Prime Contractors to accelerate delivery using established supply chains.

More crumbs from the table for SMEs

The DIS rightly notes the importance of SMEs to drive innovation and growth, and while a 50% increase in direct MOD spend with SMEs is promised, this is from a very low starting point and the equipment budget will continue to serve up big juicy steaks for the Primes while waving cocktail sausages under the noses of SMEs.

But the DIS is an improvement and does acknowledge the difficulties defence SMEs face with basic things like everyday banking, never mind raising investment. I've written before about the challenges facing SMEs trying to break into the defence market, and the DIS could and should go further - more on that later....

Rotorcraft/Helicopters not a priority

The DIS states there "are sub-sectors where strategic imperative requires full, or majority, industrial capability to be UK-based", and "others where varied levels of autonomy in the UK is required to conduct military operations and protect sensitive technologies". The following lists make no mention of rotorcraft or helicopters, continuing a strategic neglect that has been evident for several years now.

This confirms my suspicions that the long-overdue New Medium Helicopter programme is to be cancelled, leaving a void in UK helicopter manufacture that calls into question the future of Leonardo's Yeovil facility and by extension the ability of the UK to fully participate in the design, development and manufacture of the NATO Next Generation Rotorcraft Capability programme.

"Clear demand signals" at last?

One of the major challenges for companies operating in the defence world is the difficulty in forecasting future sales and revenue, and hence planning investment and capacity. The MOD has published Equipment Plans and Acquisition pipelines in the past, but rarely succeeded in keeping to indicated milestones for bid, contract award, delivery etc and the Acquisition Pipeline appears as an unwieldy spreadsheet in which programmes appear and disappear without commentary. The DIS promises to deliver a "clear government demand signal provides industry with long-term direction" which will be extremely welcome if actually achieved.

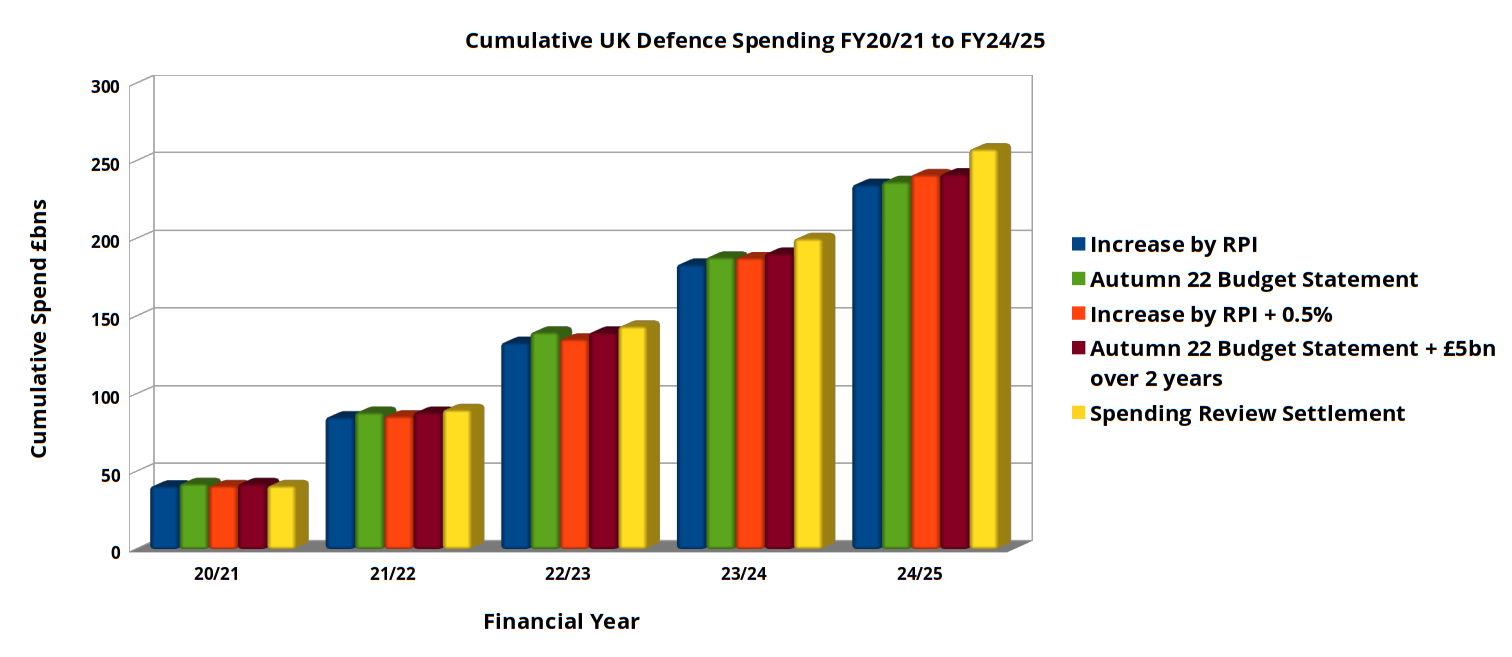

However what the DIS fails to do is look one step upstream at the budgeting process, where MOD budget holders have long been in the habit of "over-programming" spending plans which present impossible outcomes requiring the MOD to spend more money than is actually available, particularly in early years. This nonsensical situation bakes in the guarantee that programmes will need to be delayed, cut, or cancelled altogether and leaves industry second-guessing which programmes will fail to proceed as planned.

The Government should simply ban MOD budget holders from over-programming spending plans, once and for all.

The missing link - support SMEs with managing currency exchange rates

One under-reported challenge affecting defence SMEs in the UK is managing foreign currency exchange rate fluctuations. Many defence companies will be importing materials or components from foreign suppliers, to be paid for in foreign currency, even if selling to the UK MOD or Prime Contractors. And of course defence exports are usually invoiced in foreign currency as well.

This is an issue because the time lag between submitting a bid with prices to your customer and then finally delivering and invoicing should you win is often measured in years, giving plenty of time for exchange rates to change, sometimes quite dramatically. Adverse currency movements can wipe out the expected profit on a contract, presenting a significant risk that has to be managed.

While banks and other institutions offer contracts to fix future exchange rates, these don't help at the bid stage when the delivery profile and even quantities aren't fixed and are likely to change. Bidders can attempt to mitigate the risk by applying a safety factor to exchange rates used in price calculations, or adding complexity to the bid by requesting a price variation formula that includes exchange rates, but the former have the effect or increasing the sticker price of the bid, and the latter is usually not welcomed by the customer and may make the bid non-compliant. Either way, the resulting bid is less competitive.

One solution to make bids by UK SMEs for both MOD and export contracts more competitive would be for the Government to task UK Export Finance with offering an exchange rate guarantee service, with rates fixed for future contracts at the bid stage, with sufficient flexibility to accommodate the uncertainty regarding quantities and delivery timescales that are inherent in major defence programmes.

Overall, it's not a bad document and mostly says the right things (usually several times), but the continued lack of urgency from the UK Government regarding defence matters is a concern, and there is still more to be done to help innovative SMEs thrive in the defence world.